by Steve Cortes

Americans who already own homes find themselves in an enviable position presently, particularly if they have little/no debt on them, or mortgages locked-in at super low rates that dominated the pre-lockdown years. But for the aspirational strivers in society – newlyweds or parents having more children, or the upwardly mobile entrepreneur seeking a better house – the present housing crisis presents a conundrum.

In short, the housing market is not functioning as it should, based on normal incentives and most of real estate market history. Specifically, interest rates have surged, and yet home prices stay sky-high. Even CNN concedes this twisted reality, running a recent story with the headline question: “Why Isn’t the Housing Market Behaving the Way It’s Supposed To?”

On the rates side, consider that the benchmark 10-Year Treasury yield has soared from 0.95% in March of 2020, when we supposedly embarked upon “15 days to slow the spread,” to 4.11% today.

That quadrupling of the world’s most important market interest rate flows directly from the exorbitant federal borrowing and spending that commenced with the 2020 lockdowns. Then, Biden compounded the massive initial 2020 errors. Once the unnecessary, created Covid panic subsided, rather than revert to budgetary sanity, Biden ramped up the fiscal profligacy even further.

As a result, the Federal Reserve, which suddenly finds monetary religion, fights hard against this inflation by raising rates, but finds limited success as the central bank’s tighter monetary policy slams headfirst into the fiscal gluttony of Biden and his budget allies on Capitol Hill, including many Republicans like Mitch McConnell and Lindsey Graham.

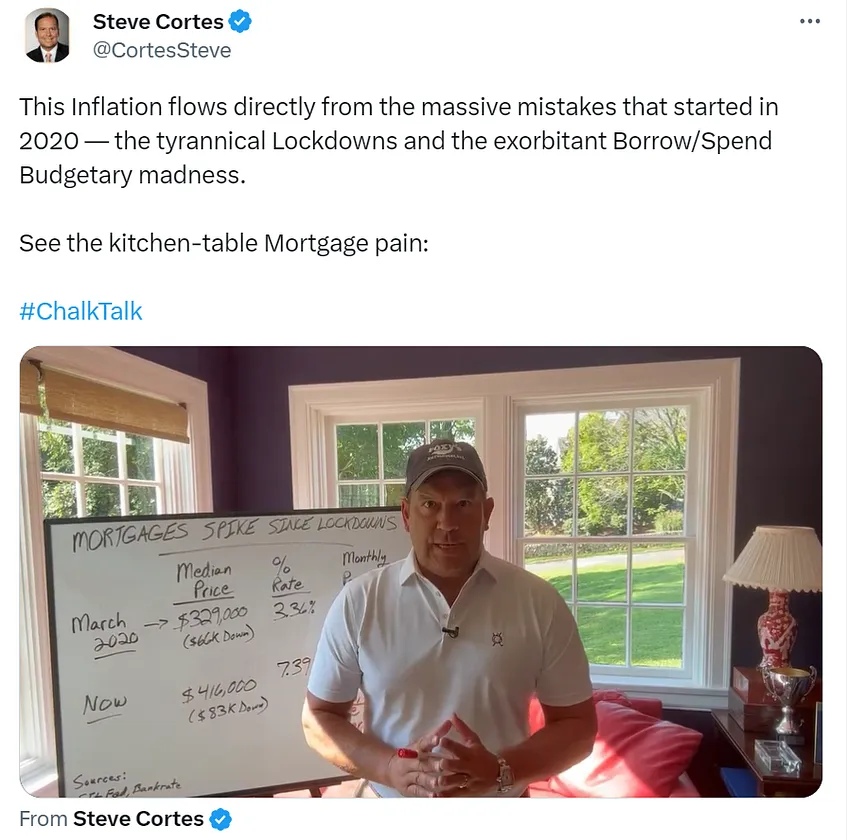

In response, mortgage rates skyrocket. As I pointed out in this Chalk Talk, the monthly fee for a median priced home in America rose by a stunning 82% from the beginning of the lockdowns until today, from $1,444/month to $2,621/month. That monthly payment also assumes that the buyer can muster $83,000 in cash for a down payment, which is nearly impossible for most Americans right now in this era of crashing real wages.

Not surprisingly, then, demand for new mortgages tanks, whether looking at new loan originations or refinances. Now, in normal market economics, when demand for a product plunges, as has happened in mortgages, then the price of the product declines to “move inventory.” That reduction in the price of loans (the interest rate) has not and cannot occur now, though. Why? Because the inflation that bedevils shoppers at the supermarket and gas station also requires banks to earn substantial interest to make any loans profitable for the lenders, even if such high rates materially deter would-be borrowers.

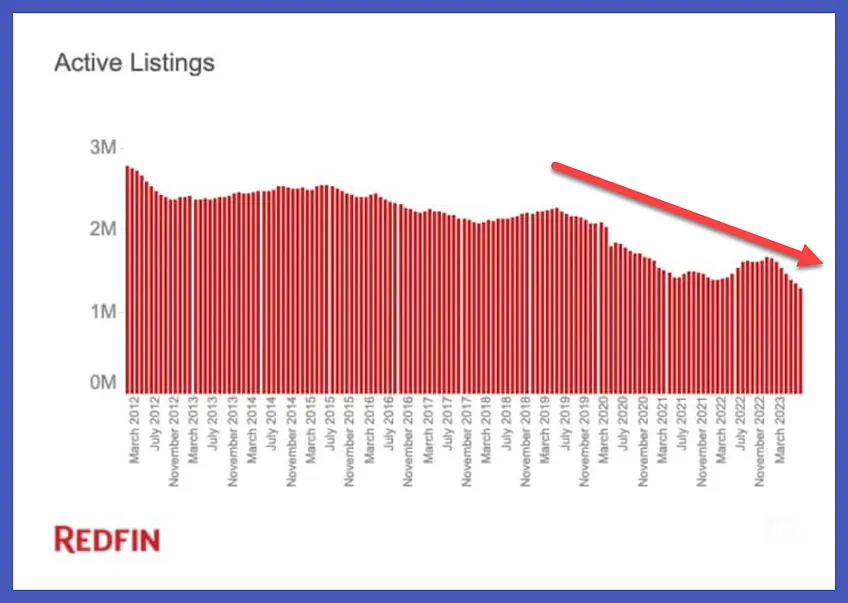

Typically, such low demand for mortgages would then force large concessions in home prices. But this normal market function has also been perverted by Biden’s inflation crisis and by lingering fallout of the lockdowns. First, far too many current homeowners resist moving, even if they prefer to relocate, simply because they enjoy such beneficial low rates on their current dwelling. Those low rates are not transferable to a new home, so millions effectively “squat” where they are, and vastly reduce the supply of available homes, keeping prices on the for-sale market elevated.

In addition, the supply-chain and workforce shortages caused by the lockdowns and workplace Big Pharma/Fauci mandates led to massive hurdles for homebuilders. Those obstacles slow construction to this day. Moreover, regulations in many locales in America stymie affordable construction, especially in Democrat jurisdictions like California, where a maze of environmental, zoning, and permitting rules make homebuilding a slog. Given these obstacles, builders naturally focus most of their attention on higher-end homes only, where the profit margins are fatter and justify the aggravations of building in today’s market.

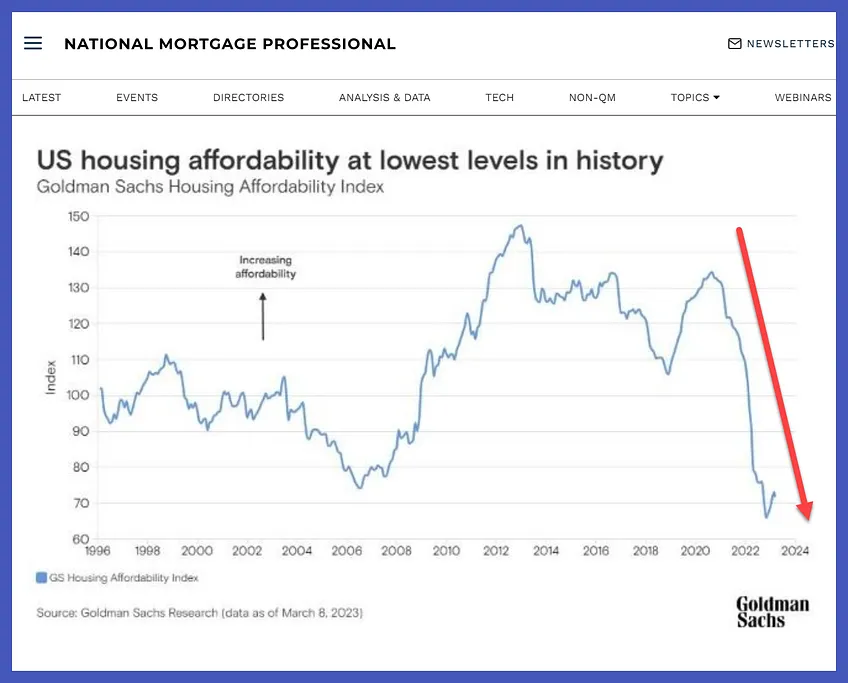

So, the brutal combination of 20-year highs on mortgage rates plus still very elevated home prices creates the worst housing affordability crisis ever, per Goldman Sachs’ affordability index that goes back almost three decades, shown here:

By most metrics, in fact, affordability is now worse than even during the height of the 2006-07 housing boom that led to the 2008-09 bust and global credit crisis. For example, the median worker now spends 43% of income on shelter, far above the 30% ceiling recommended by personal finance advisors.

So, what can be done? Four reforms that would matter:

1. Stop Spending! – for starters, massively reverse the gargantuan levels of borrowing and spending from the federal government. Is such a grand turnabout politically possible? The task is admittedly difficult, but the inflation right now is so biting for so many citizens, that the time is ripe to persuade on fiscal sanity.

2. Make Construction Great Again – at the state and local level, the huge impediments to home construction must be eliminated or at least streamlined and reduced.

3. Outlaw Institutional Encroachment into Single Family Homes – Insurer Met Life projects that, by 2030, institutional investors will own 40% of all homes for rent in America. But we can outlaw this practice now and prevent the giant asset managers from dominating single-family homes and pricing out hard-working families.

4. Restrict Immigration – the current de-facto open border of Joe Biden has welcomed in at least 6 million illegal migrants already since he took office. This human tsunami of uninvited, unvetted newcomers puts enormous strain on the housing stock of America. Securing borders will protect our national security, street safety, and wages for citizens – but it will also lower housing costs for Americans.

Without a major course correction, affordable housing will soon become available only to the wealthy. This present crisis demands forceful policy responses, as outlined above.

– – –

Steve Cortes is a contributor to American Greatness.